Bookkeeping Courses

Contents:

Merritt Bookkeeping is a cost-effective remote bookkeeping solution that’s available at a flat rate with no restrictions on the number of transactions or the frequency of service. Merritt ranked high among users, with the best scores of all providers listed here. It’s praised for its ease of use and accessible customer service. Merritt Bookkeeping offers a flat rate of $190 per month, with no restriction on the number of monthly transactions or the frequency of the service.

Wellsburg voters to determine if positions are elected or appointed – The Steubenville Herald-Star

Wellsburg voters to determine if positions are elected or appointed.

Posted: Thu, 13 Apr 2023 06:26:09 GMT [source]

Enrol and complete the course for a free statement of participation or digital badge if available. Get free access to resources, guides, and exclusive content to boost your financial know-how. A year end package with everything you need to file comes standard with Bench. With Premium, you get expert tax prep, filing, and year-round tax advisory support. FreshBooks is a commonly used software among freelancers and small business owners. The free option gives you access to the text version of topic explanations and a handy quiz to test what you’ve just learned.

ACC2384 Microcomputer Applications in Accounting

Its biggest drawback is that it only offers basic bookkeeping services, excluding bill payment and invoicing. The lack of access to tax and consulting services and financial advice is also a con. Merritt Bookkeeping scored the highest of our online bookkeeping providers in the pricing category—at an affordable $190 per month, it’s a transparent and fixed rate. Being a Merritt Bookkeeping customer also eliminates the need to pay a subscription fee for accounting software as Merritt will handle everything for you. Freelancers and startups often working remotely will appreciate the iOS mobile app that provides financial reporting functionality and real-time cash flow updates. Upon enrollment, you’ll have access to a team of in-house bookkeepers, and you can book a monthly check-in or tax season review call with them at no additional charge.

Access to a personal tutorYou will have access to a tutor when you need assistance with any of your classes. Get the latest in tax and small business updates and issues that affect your finances and growth prospects. What is an independent financial advisor, and why is it essential to have one working on your side?

- We understand that as a small business owner, you don’t have any extra time.

- A minimum grade of C (65%) is required in all Algonquin College courses used for exemptions in the CIB professional development program.

- By continuing to use or access the Services after the updates come into effect, you agree to be bound by the revised Terms.

- As your business grows and your financial transactions increase, you will need a virtual bookkeeper to do routine tasks like classify transactions and reconcile bank accounts.

- At the beginning of each module you’ll be presented with the course content and assignments necessary for completion.

classified balance sheet Live is our top pick for online bookkeeping services because it offers cleanup bookkeeping services that vary based on your company’s needs for your first month. This service is ideal for business owners who want to get their bookkeeping in order but don’t have the time or resources to do it themselves. Start with the foundation of online bookkeeping services and add-ons that take the tactical and day-to-day items off your plate. For accrual accounting and more complex needs, lean on your controller and accountant. Bookkeeper360 is our top overall option because of its scalability, wide range of add-on services and multiple accounting integrations.

How To Choose a Virtual Bookkeeper for Your Business

That’s because it offers a prerevenue discount of $200 per month. Each plan comes with a finance expert, automated transaction imports, P&L, balance sheet and cash flow statements. You’ll also get burn rate calculations, which is helpful for startups that need to closely track their spending. When you have a Small Business Plus plan or higher, you get unlimited online support. All plans come with onboarding, a dedicated bookkeeper and account manager, reconciliation at month-end, balance sheet, P&L, statement of cash flows and a portal with document storage.

Intuit Bookkeeping Expert Careers Remote Bookkeeping Jobs … – intuit.com

Intuit Bookkeeping Expert Careers Remote Bookkeeping Jobs ….

Posted: Tue, 11 Apr 2023 04:19:15 GMT [source]

And when my small business consulting and full service accounting firm hit capacity in it’s first year I realized I can only work one-on-one with so many people. The course focuses on solving analytical problems and completing exercises, review questions, marked assignments and payroll regiters to build the necessary skills required in processing a payroll. As a bookkeeper, you need to be confident in managing projects and divisions; develop your knowledge of payroll administration, as well as management accounting.

Office of Continuing & Professional Education

Our partners cannot pay us to guarantee favorable reviews of their products or services. We sometimes release products and features that we are still testing and evaluating. Those Services have been marked beta, preview, early access, or evaluation and may not be as reliable as other non-beta services, so please keep that in mind. We collect and use the personal data described above in order to provide you with the Services in a reliable and secure manner. We also collect and use personal data for our legitimate business needs.

- Full BioMary is a journalist with 14+ years of professional writing experience, her work has been published internationally by Forbes, HuffPost, Business Insider, The Points Guy, AOL, and SheKnows.

- Another drawback is that the software lacks bill payment and invoicing capabilities.

- They can create and send invoices and make sure they’re entered into the right accounts in the accounting system.

- For a list of trusted third parties that we use to process your personal information, please see our third party vendors below.

- Our overall best online bookkeeping service is Bench because it provides bookkeeping support at a lower cost than many similar platforms while also offering tax assistance and payroll integration.

With that information, you can cut spending where needed and watch your income and profitability grow intentionally. We understand that as a small business owner, you don’t have any extra time. That’s why we designed this course to teach you the essentials of bookkeeping in practically no time at all.

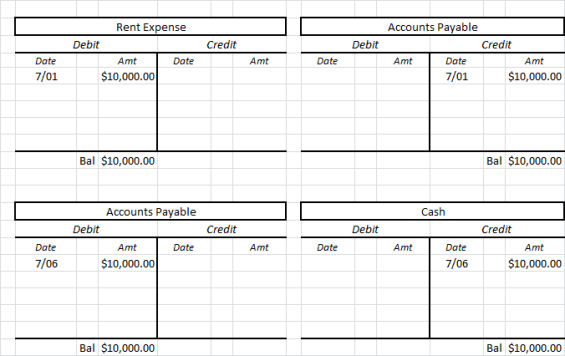

Discover how you can balance work, life, and school to develop the skills to help you advance in your current career or help you take the next steps toward building a new one. The two primary principles of bookkeeping are that every debit must have a corresponding credit and all accounts must balance. These principles ensure accurate and detailed financial reports regarding a business’s financial state. Just because an individual has bookkeeping experience or knowledge, does not mean they are qualified for any career that includes bookkeeping tasks.

While https://1investing.in/360 is our best recommendation for Xero users, it also works well for QuickBooks Online users not satisfied with the limited services of QuickBooks Live. While it lacks its own mobile app, you can use QuickBooks Online’s app to access your books. It’s ideal for businesses looking to outsource their bookkeeping with a full-service accounting firm. If you are behind on your bookkeeping, you can use Bench’s Catch Up and Retro bookkeeping services to bring your books up to date. Learn about the essential numerical skills required for accounting and bookkeeping.

We’ve analyzed the best bookkeeping services to help you find the right solution quickly and easily. We selected these services based on their service options, pricing, customer service, reputation and more. A. The Accounting Services Course includes, in addition to all content of the Bookkeeping Course, additional education on tax and payroll processing.

Stress-Free Bookkeeping – Accurate Financials Always on Time

PRO Access costs $49 and provides additional video courses, quick assessments, business forms, and more. Its features include study flashcards and tests with coaching included. AccountingCoach, LLC is a web-based educational platform founded in 2003 by Harold Averkamp. Averkamp is a certified public accountant who holds a masters in business administration and has more than 25 years of experience in the accounting field. The company offers a great variety of accounting courses, covering accounting basics, bookkeeping, financial statements, and more—all completely free.

Users also praised the virtual accounting firm’s business formation services and the transparency of fees and services. Block Advisors is a branch of H&R Block that provides tax, bookkeeping, and payroll support. It’s a great option if you’re looking for reliable and efficient support year-round.

Someone with an advanced degree could also be interested in founding their own bookkeeping firm and contracting out employees to other businesses. Sign up to receive more well-researched small business articles and topics in your inbox, personalized for you. We consider the opinion of users and the service’s ratings on various review sites. This criteria was disregarded for providers where no reviews were found.

Fit Small Business content and reviews are editorially independent. Enrolled students receive a one year subscription to QuickBooks Online. Curriculum covers essential knowledge from assets and liabilities to revenue and expenses, a comprehensive understanding of QuickBooks Online Plus™, and a special final project involving business ownership. Explore a pathway towards a career that interests you while earning your high school diploma online. OpenLearn works with other organisations by providing free courses and resources that support our mission of opening up educational opportunities to more people in more places.

Unless the following restrictions are prohibited by law, you agree not to reverse engineer or decompile the Services, attempt to do so, or assist anyone in doing so. You may use our Services only as permitted by applicable law, including export control laws and regulations. Finally, to use our Services, you must be at least 13, or in some cases, even older.

Unlike less versatile competitors that limit their accounting methods to accrual basis or cash basis only, the service accommodates both. Some other products either only integrate with QuickBooks or use proprietary accounting software, which makes it difficult to switch accounting services down the road. In terms of scalability, entrepreneurs can upgrade to weekly financial reports and receive support for extra services like payroll, human resources, invoicing and tax filing. This makes the product a good fit for small businesses of varying complexity. Our team moves quickly so you can make informed decisions faster.

By consenting to receive communications, you agree to the use of your data as described in our privacy policy. Email me about the educational programmes that GetSmarter (a brand of 2U, Inc.) and the 2U family of companies offer with multiple institutions. Your certificate will be issued in your legal name and couriered to you, at no additional cost, upon successful completion of the course, as per the stipulated requirements. The ability to manage debtors and creditors ledgers, and produce bank reconciliation statements. Skilled bookkeepers are an invaluable part of any organisation. Without them, companies would find it challenging to maintain financial clarity and keep track of the information needed to make important operating and financing decisions.